High Tide (HITI)·Q4 2025 Earnings Summary

High Tide Posts Record Revenue and EBITDA, Stock Drops 7% on Near-Term Concerns

January 30, 2026 · by Fintool AI Agent

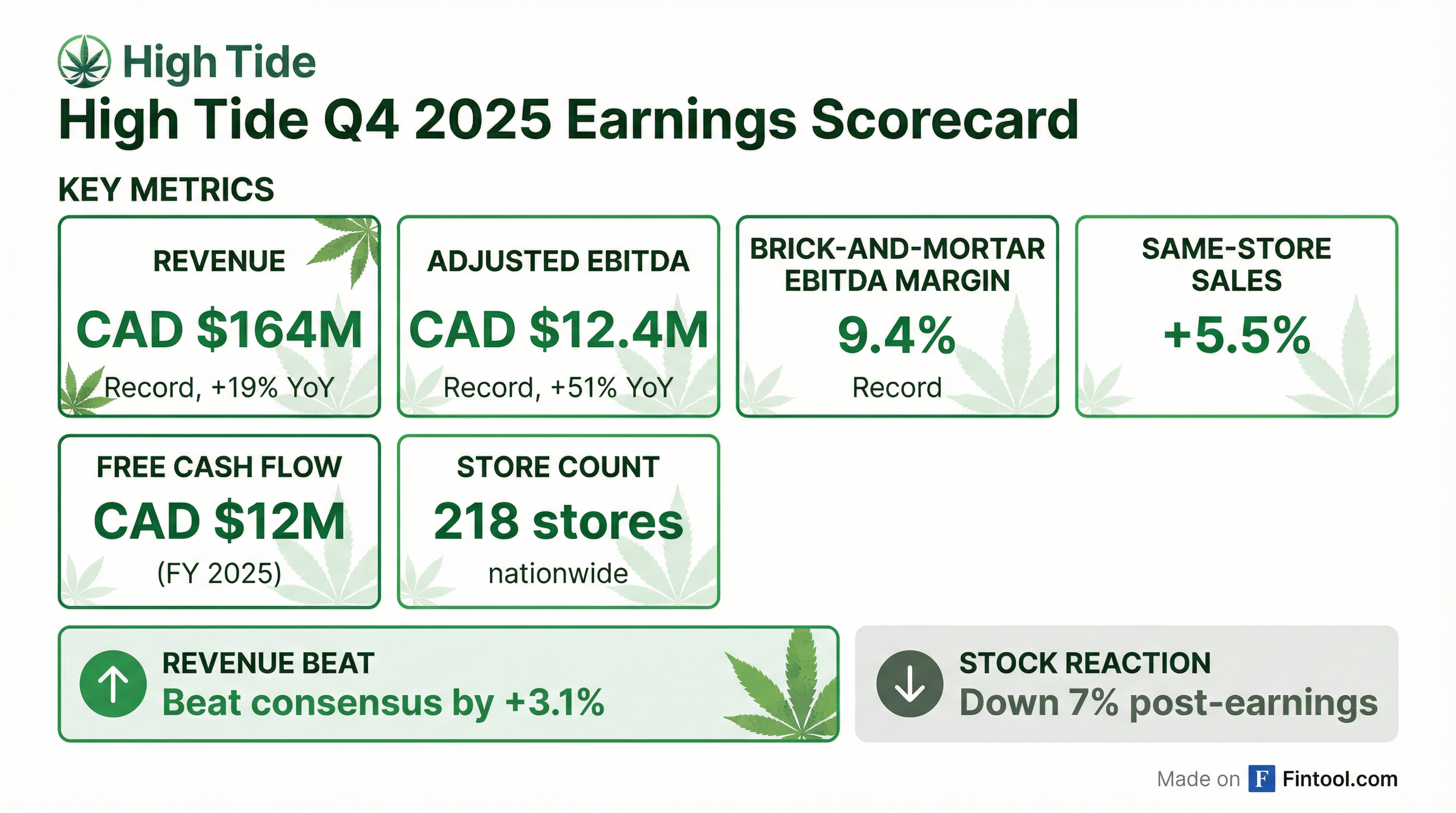

High Tide Inc. (NASDAQ: HITI) delivered record Q4 2025 results with CAD $164 million in revenue (+19% YoY) and CAD $12.4 million in adjusted EBITDA (+51% YoY), beating consensus estimates by 3.1%. Despite the strong quarter, shares fell approximately 7% as investors focused on near-term margin headwinds from the company's German medical cannabis acquisition.

Did High Tide Beat Earnings?

Revenue: High Tide beat revenue consensus by 3.1%, reporting $117M USD actual vs. $113M USD expected.* The CAD $164 million in quarterly revenue represents a record for the company and an annual run rate exceeding CAD $650 million.

Adjusted EBITDA: CAD $12.4 million for the quarter, up 51% year-over-year and 17% sequentially.

Net Income: The company reported a GAAP net loss of CAD $45.9 million, driven by two non-cash items: a CAD $23.6 million goodwill impairment on the e-commerce segment and a CAD $23.5 million derivative liability charge related to the Remaxion put option and warrant revaluation. Adjusted for these non-cash charges, net income was positive CAD $1.4 million or CAD $0.02 per share.

Free Cash Flow: CAD $1.3 million for Q4 and CAD $12 million for the full fiscal year, meeting the company's stated objective of remaining free cash flow positive.

*Values retrieved from S&P Global

What Drove the Record Quarter?

The brick-and-mortar segment continues to be the star performer, generating 92% of revenue with 15% year-over-year growth. The segment delivered record adjusted EBITDA of CAD $14.1 million with a 9.4% margin—the fourth consecutive quarter of margin improvement.

Key drivers of the brick-and-mortar outperformance:

-

Cabana Club loyalty program explosion: 2.5 million members in Canada, up 45% year-over-year at the fastest growth pace in four quarters.

-

ELITE tier momentum: 151,000 premium members, up 107% year-over-year, with higher basket sizes and shopping frequency.

-

Market share gains: 12% market share in the five provinces where High Tide operates, up from 11% a year ago. In October, the average Canna Cabana store was on a CAD $2.6 million annual run rate—2.2x the industry average.

-

White label portfolio: Private label products continue to drive incremental margin.

-

Competitive attrition: Alberta store count excluding High Tide contracted 5% while HITI grew 10%. In Ontario, High Tide accounted for effectively all growth in the province.

What's the Remaxion Situation?

The Remaxion acquisition (51% stake in German medical cannabis distributor) contributed nearly CAD $10 million of revenue in less than two months. However, temporary supply chain issues are pressuring near-term margins:

The Problem: Delays in biomass releases from Portugal, where much of Europe's cannabis is processed. Some biomass is up to 10 months old and being sold at single-digit gross margins as it approaches expiry.

The Timeline: Management expects this headwind to continue through Q1 and into early Q2 2026, with "super green pastures" from Q3 onwards.

The Mitigation: High Tide has diversified processing routes through Malta, Czech Republic, and directly in Germany. The first Canadian-sourced shipment should arrive in Germany by early March. Importantly, High Tide is procuring biomass at prices 30-40% below what Remaxion was paying independently.

The Valuation: The acquisition was priced at just 3.6x EBITDA specifically to account for these temporary headwinds. Management views the Portugal situation as "one big reason we were able to negotiate such a low multiple."

"We paid 3.64x for this business, and Portugal was one big reason we were able to negotiate such a low multiple... The growth that this business is demonstrating is exponential." — Raj Grover, CEO

How Did the Stock React?

Despite record operational results, HITI shares dropped approximately 7% on January 30, 2026, trading around $2.26 versus the prior close of $2.43.* The selloff appears driven by:

- Near-term Remaxion headwinds impacting consolidated margins through H1 2026

- Working capital investment of CAD $2.3 million compressed Q4 free cash flow

- Caution on U.S. expansion timeline amid regulatory uncertainty

The stock is down approximately 40% from its 52-week high of $4.06, though management remains focused on fundamentals rather than short-term price action.*

*Values retrieved from S&P Global

What Did Management Guide?

High Tide did not provide specific financial guidance but outlined several strategic priorities:

Store Expansion: 20-30 new stores planned for calendar 2026, consistent with the prior year. The company reiterated its goal of exceeding 350 locations (currently at 218).

M&A Appetite: Management is in discussions regarding potential acquisitions of "40, 50, and maybe even larger" store portfolios. CEO Raj Grover indicated M&A announcements are likely in 2026: "I think you can count on some M&A this year."

Cabana Club Target: Long-term goal raised to 3 million members nationwide.

U.S. Expansion: Following President Trump's December 18 executive order advancing cannabis rescheduling, High Tide has received inbound interest from "multiple large U.S. operators." The company is evaluating options "from licensing agreements to full-blown mergers" but cautioned they are "proceeding with caution."

CBD Opportunity: The proposed Medicare pilot program offering seniors up to $500/year in CBD product coverage could be "a game changer" for NuLeaf Naturals and FAB CBD brands.

Key Operational KPIs

What Should Investors Watch?

Near-term (Q1-Q2 2026):

- Remaxion margin normalization as Portugal biomass clears

- First Canadian-sourced shipments arriving in Germany (March)

- Potential M&A announcements in Canada

- U.S. rescheduling news (expected "next month" per management)

Medium-term (H2 2026):

- UK medical cannabis market entry planned

- Remaxion contribution at full run rate with normalized margins

- Continued same-store sales momentum

- Progress toward 350-store target

Key Risks:

- Execution risk on Remaxion integration and European expansion

- Canadian cannabis market saturation (though HITI continues taking share)

- U.S. regulatory timeline uncertainty

- E-commerce segment remains challenged (fully impaired)

Management Tone Check

CEO Raj Grover's tone was notably bullish despite the stock's reaction, emphasizing the temporary nature of Remaxion headwinds:

"Getting past the noise of Q1, remember, this multiple was already baked in... You don't buy a business for 2, 3, 4, 6 months. You buy a business for the long term, and I cannot tell you how bullish I am on the prospects of Remaxion long term."

On the competitive position in Canada:

"If anyone tried to replicate our model, which many have tried and failed... we're so far ahead now, and we're so far dominating now, I don't think anyone will be able to catch up with us."

Bottom Line

High Tide delivered a clean beat with record revenue and EBITDA, driven by continued brick-and-mortar excellence and loyalty program momentum. The 7% stock drop reflects near-term margin pressure from Remaxion rather than fundamental deterioration. For investors focused on the long-term cannabis retail opportunity, the key question is whether management can successfully execute on European expansion while maintaining Canadian dominance—early signs suggest they're on track, but patience through H1 2026 will be required as the Remaxion supply chain normalizes.